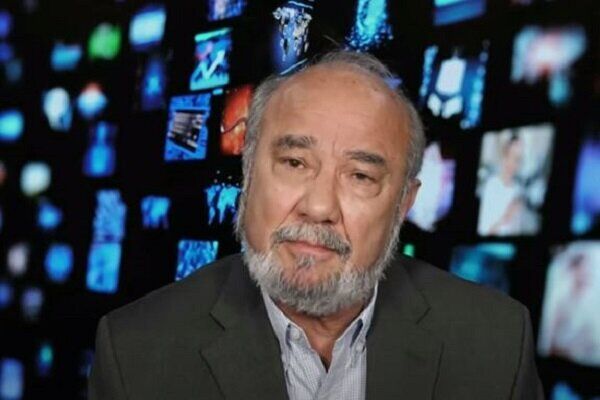

TEHRAN(Bazaar) – Professor Hossein Askari, who teaches international business at the George Washington University, says economic growth will decline dramatically in Russia, without a doubt a recession is on their horizon and growth decline by 4-5 percent.

He adds if the war in Ukraine continues, Europe will be convinced of a complete cut-off of Russia from Swift.

Following is the text of the Bazaar interview with Professor Hossein Askari.

Bazaar: What are the economic consequences of the Ukraine crisis for Russia and Europe? Will Europe not face the problem of energy imports?

Askari: Economic growth will decline dramatically in Russia, without a doubt a recession is on their horizon and growth decline by 4-5 percent. Europe will see a slow down in growth, my guess is crisis could take off 1.5% from earlier forecasts. Yes, Europe will face higher oil prices and much higher natural gas prices and there could even be natural gas shortages, depending how hostilities play out.

Bazaar: Following the Russian invasion of Ukraine, the United States announced the possibility of Russia cutting ties with Swift. What effect will the severance of Russia from Swift have on Russia's foreign trade and to what extent will it affect its economy?

Askari: Basically, if Russia’s ties to SWIFT are severed, Russia will have difficulties in receiving payments for its exports and paying for its imports by issuing Letters of Credit. Russia’s cost of trade will jump. China could help out, but how will China want get involved? Your guess is as good as mine. It would have sanctions dangers for China. This thing could spiral out of control. And if Russia’s exports are severely reduces for about a year, its economy and its currency would crash.

Bazaar: Europe imports energy from Russia. Russia's disconnection with Swift will make it difficult for European countries to import fuel from Russia. In such a case, is it possible that the United States will not impose sanctions on European energy imports from Russia?

Askari: If Europe goes along with it, U.S. task would be easier. But the U.S. is also hesitant because of what this would increase oil and gas prices, hurting U.S. consumers and economic growth.

Bazaar: Russia has established the System for transfer of financial messages (SPFS), a Swift-independent financial system since 2015. There are about 20 Russian banks operating in the SPFS, and it seems that the presence of foreign banks in it is also needed at the moment. Can this system smooth Russia's foreign trade?

Askari: No. Not a chance.

Bazaar: Germany has good economic relations with Russia and opposes extensive sanctions against Russia. Does Europe have a consensus on sanctions against Russia?

Askari: No. Germany is the problem. The UK is ready to cut off Russia from SWIFT and has done more than any other European country. But I think there could be consensus if the war drags on with more Ukrainian casualties seen on TVs, if the U.S. and Qatar would divert more LNG to Europe and if the U.S. can get Arab Persian Gulf countries to increase oil output.

نظر شما