TEHRAN (Bazaar) –Robert Kormoczi, Content Distribution Manager at SEON, in interview with Bazaar News Agency said: KYC perhaps the best process to help organizations verify the identity of the customer and ensure they are not performing any illegal activities or money laundering.

Following is the full text of the interview:

Bazaar: What have been the biggest security threats in the e-commerce sector in recent years? Explain them, please.

Kormoczi: In the past two years, Covid has limited people’s mobility and access to physical purchases and in-person services. Due to lockdowns and unpredictable curfews, a lot of businesses were forced to operate online. For many, going digital like retailers selling through eCommerce sites is a brand new concept, making them susceptible to fraud. This gave fraudsters a wide range of opportunities to exploit the new entrants in the online space.

Cybercriminals love to target online retailers with phishy emails, chargebacks and things like receipt fraud where a fraudster provides a stolen or forged online receipt to return merchandise for profit.

Bazaar: How much (percentage) of security threats has increased? Please tell us statistics in each area.

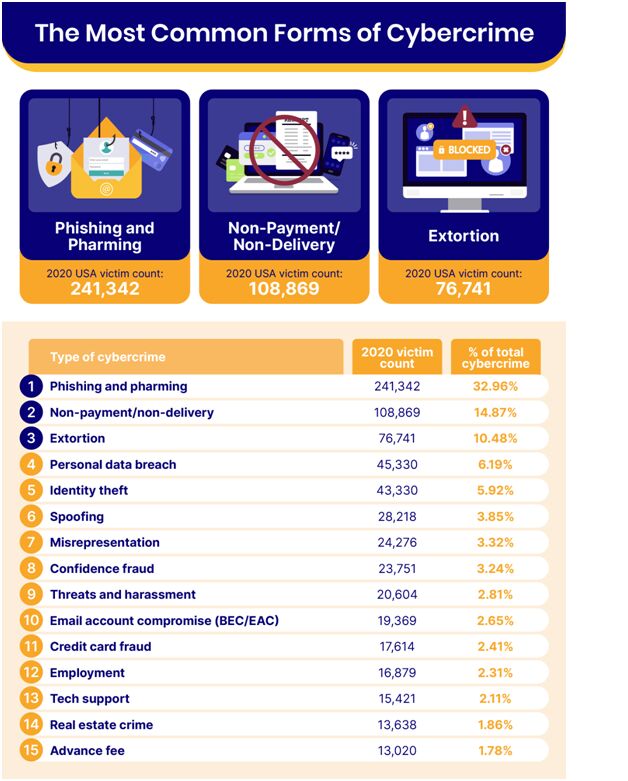

Kormoczi: At SEON Technologies, we’ve done a thorough analysis on the types of cybercrime occurring mainly in the United States and found that email phishing and pharming are the most common types of security threats. This is followed by non-payment on delivery and extortion. While there is no clear percentage on crimes committed online, we do have the numbers from 2020 from across the states.

Source: https://seon.io/resources/global-cybercrime-report/

Bazaar: What should online businesses pay attention to in order to avoid security threats?

Kormoczi: There are multiple ways that online businesses can limit fraudster activities, but this depends on the type of online business we’re talking about.

In order to reduce user friction and fraud, online businesses (mainly SaaS and fintech) are advised to enlist the right KYC processes. Why is KYC advisable for companies? At SEON we believe that it's perhaps the best process to help organizations verify the identity of the customer and ensure they are not performing any illegal activities or money laundering.

There are 3 components of KYC:

1. First and Last Name

2. Date of Birth

3. Residential Address

These details must be validated with an official document such as a passport, driving license, or national ID. With these documents you can verify someone’s true identity since no fraudster or cybercriminal would risk revealing their identity.

Bazaar: What should people know for online shopping? (for keeping from threats)

Kormoczi: The basic rule of thumb is simple: “detect fraud in order to prevent fraud.” We normally advise precautionary measures by identifying any fraudulent activity beforehand so one can limit their access to your services. The best way to do this is through data collection. If you can collect data like name, email, IP address, social media account of someone you can verify their identity.

There are two processes for this: browser fingerprinting and social media lookup.

At the end of the day, the key takeaway is to know as much as possible about someone and see if the data points match.

نظر شما