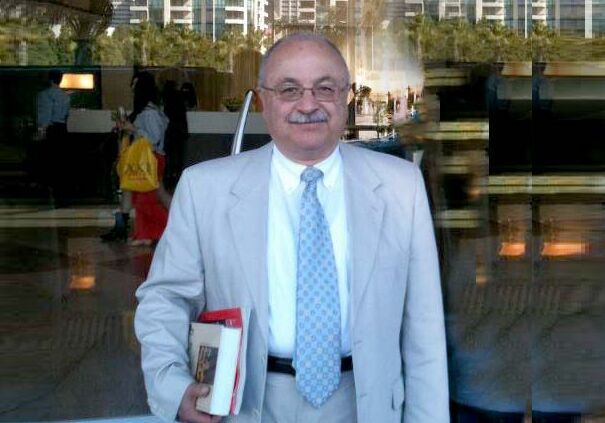

TEHRAN (Bazaar) –Nader Entessar, Professor Emeritus of Political Science from university of South Alabama says that Oil exporters have long preferred the U.S. dollar because it is the preeminent global currency for global investments. return to be useful.

“That makes it the most convenient store of value for accumulated oil revenue, which needs to earn a rate of return to be useful,” Entessar told Bazaar.

Following is the full text of the Bazaar interview with Professor Entessar:

Q: One of the pillars of the trade order after World War II was the dominance of the dollar in the international economy. To what extent was the dollar effective in the institutionalization of the American order?

A: Without the U.S. dollar's dominance in the international economy, Washington's hegemony and supremacy in the post-World War II era would have been very difficult if not nearly impossible. It was through the relentless control of international finance and capital that the United States was able to create a new world order to its linking.

Q: In recent years, de-dollarization has been pursued by various countries, including China and Russia. Even the countries of the Shanghai Cooperation Organization are looking for local currency exchanges. What is the reason for this issue and to what extent will de-dollarization be successful?

A: Although the US dollar's supremacy has been challenged in recent years, the US dollar continues to play the dominant role in international finance and trade. Today, about half of international trade is invoiced in dollars, and about half of all international loans and global debt securities are denominated in dollars. In foreign exchange markets, where currencies are traded, dollars are involved in nearly 90% of all transactions.

Moreover, today most financial transactions, international debt, and global trade invoices are denominated in dollars and close to 60 percent of global foreign exchange reserves are held in dollars. Therefore, even in the best of circumstances, it will take several years for any sustained de-dollarization effort to bear fruit.

Q: During his recent visit to Saudi Arabia, the President of China raised the issue of exchanging energy with the Chinese currency, the yuan. Is this practical?

A: Oil exporters have long preferred the U.S. dollar because it is the preeminent global currency for global investments. That makes it the most convenient store of value for accumulated oil revenue, which needs to earn a rate of return to be useful. This has been true in the case of Saudi Arabia as well. As I mentioned earlier, this is because the US emerged as the strongest economy post World War II, and the dollar was at the heart of the new financial system that was emerging at that point in time.

In mid-March of this year, The Wall Street Journal reported that Saudi Arabia was in talks with China to price some of its oil exports in terms of the Chinese currency yuan. The Journal cautioned that such a “move that would dent the dollar’s dominance of the global petroleum market”. Any move that dents the dollar’s dominance will also impact the global economy. Hence, it becomes crucial to understand what Saudi Arabia’s attempt to get closer to China means, especially at this stage of the growing Beijing-Riyadh ties. Saudi Arabia is still very much in the US orbit and any weakening of the US economy will adversely affect Riyadh’s fortunes. So, although for political reasons Saudi Arabia from time-to-time may decide to sell oil to China using the yuan, this is not going to overshadow Saudi Arabia’s ties to the United States and the dollar.

Q: Some believe that China's energy trade with the GCC members will deal a hard blow to the United States and the dominance of the dollar. Accordingly, the risk of this action is high for these countries and they may lose the military support of the United States. what is your opinion?

A: I agree with the general thrust of this argument. The GCC countries do not have much room to maneuver when it comes to alienating their most significant patron, namely the United States. They are too beholden to their political and military master to be able to seriously challenge the West, especially Washington, in a sustained way.

Q: Regarding the plan to create a free trade zone between the GCC and China, what is the importance of this issue in the competition between America and China in this region?

A: It will obviously challenge America's hegemony in the region and will add a new twist to the ongoing global competition between Washington and Beijing. However, this and other economic moves should not be viewed as an “either-or” scheme because international economics and trade are not a zero-sum game.

نظر شما